Title: How to Research Environmental Stocks

Investing in environmental stocks can align your portfolio with sustainable practices while potentially generating financial returns. Here's a guide on how to research environmental stocks effectively:

1. Identify Environmental Sectors

Renewable Energy:

Look for companies involved in solar, wind, hydro, or other renewable energy sources.

Clean Technology:

Research firms developing innovative solutions for pollution control, waste management, or energy efficiency.

Water and Waste Management:

Explore companies focused on clean water technologies, recycling, or wastetoenergy initiatives.

Sustainable Agriculture:

Investigate businesses promoting organic farming, sustainable forestry, or ecofriendly food production.

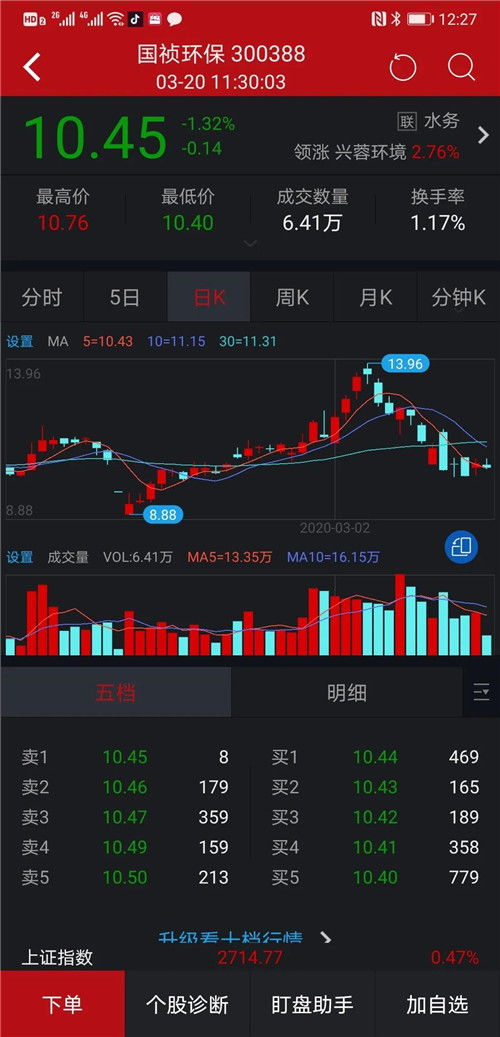

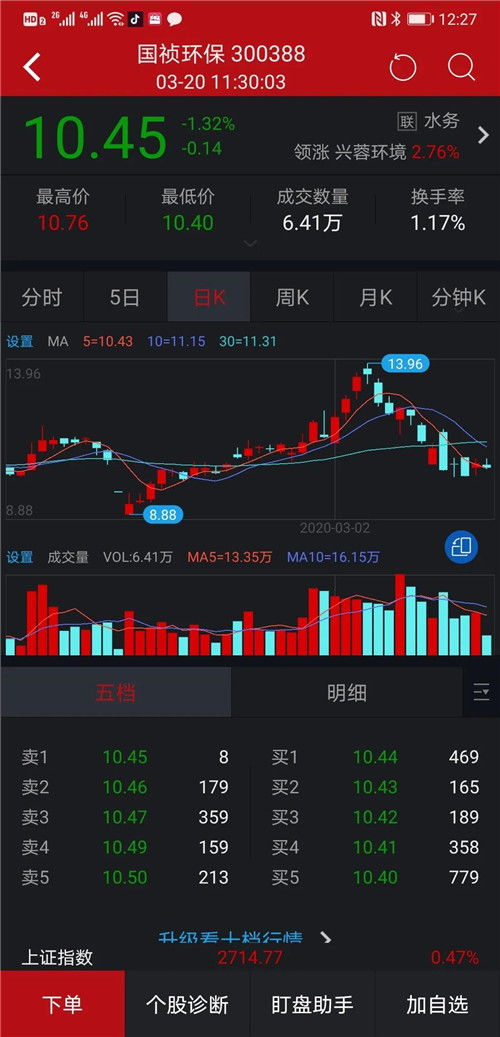

2. Use Financial Platforms

Stock Screeners:

Utilize stock screeners on financial websites to filter companies by sector, market capitalization, and financial metrics.

EcoFocused Funds:

Consider investing in mutual funds or exchangetraded funds (ETFs) specializing in environmental or socially responsible investments.

Company Reports:

Access annual reports, quarterly earnings releases, and investor presentations to understand a company's financial health, growth prospects, and environmental initiatives.

3. Assess Environmental Impact

Carbon Footprint:

Evaluate a company's carbon emissions and its commitment to reducing greenhouse gas emissions.

Resource Management:

Analyze how efficiently the company utilizes resources like water and energy in its operations.

Environmental Policies:

Investigate the company's environmental policies, including waste management practices and pollution prevention efforts.

4. Consider Regulatory Landscape

Government Policies:

Understand how governmental regulations and incentives impact the company's operations and growth prospects.

International Agreements:

Consider the company's compliance with international agreements and treaties addressing environmental issues.

5. Evaluate Financial Performance

Revenue Growth:

Assess the company's revenue growth trajectory, especially in environmentally focused segments.

Profitability:

Analyze the company's profitability, margins, and return on investment compared to industry peers.

Debt Levels:

Evaluate the company's debt levels and its ability to manage debt obligations amidst changing market conditions.

6. Review Reputation and Corporate Governance

Stakeholder Engagement:

Look for evidence of positive relationships with stakeholders, including employees, communities, and environmental organizations.

Board Diversity:

Evaluate the diversity and expertise of the company's board of directors, particularly regarding environmental stewardship.

Corporate Social Responsibility:

Consider the company's overall commitment to social and environmental responsibility beyond financial performance.

7. Seek Expert Insights

Analyst Reports:

Read research reports from financial analysts specializing in environmental investments.

Industry Experts:

Seek opinions from environmental experts, sustainability consultants, or socially responsible investment advisors.

Online Communities:

Engage with online forums or social media groups focused on sustainable investing for peer insights and recommendations.

Conclusion

Researching environmental stocks involves analyzing companies' environmental impact, financial performance, regulatory environment, and corporate governance. By leveraging financial platforms, assessing environmental initiatives, and seeking expert insights, investors can make informed decisions aligned with their values and financial goals.

Remember, investing involves risks, so it's essential to conduct thorough research and consult with financial professionals before making investment decisions.

Disclaimer:

The information provided here is for educational purposes only and should not be construed as investment advice. Always do your own research or consult with a qualified financial advisor before investing.